- Tech Safari

- Posts

- Africa At Scale

Africa At Scale

Cracking the African Expansion Puzzle

Hey there, Sheriff and Caleb here.

Last month, we brought 150 executives from across the globe to Nairobi to discuss the hardest question in African tech: expansion.

Because while many companies say they want to be Pan-African, only a few have pulled it off.

Today, we’re diving into everything we learned from some of Africa’s best expanders.

Make sure to stay till the end, as we’re launching something new, just for you.

But first, we have an announcement…

We’re coming to Cape Town! 🇿🇦

Hey hey! 👋🏾

Tech Safari is coming to Cape Town on Wednesday, November 12th, and we're hosting a Community Mixer!

It's an event for founders, operators, investors and creators in South Africa's tech ecosystem.

Join us for a night of:

🎤 Punchy discussions with leaders in Africa's tech space

🤝 Networking and connections

🍿 Great food and drink

🎟️ Tickets are capped (there's only a few early birds available) so once sold out, well.. it's sold out.

Now, let’s get into the story.

Everyone wants to expand into and across Africa…until they try.

At first glance, the motive makes sense.

It’s a continent with 1.5 billion people, a young mobile population, and fast-growing economies.

And on paper, the task looks simple.

Hire a local team, crack a big market, and repeat everywhere else.

But the ground truth is messier.

Africa isn’t one cohesive market. It’s 54 countries, different systems, and hundreds of laws.

Plus millions of customers who don’t buy, pay, or trust brands the same way as each other.

Every new border rewrites the rulebook.

And sometimes, companies learn these rules the hard way.

Like Chipper Cash

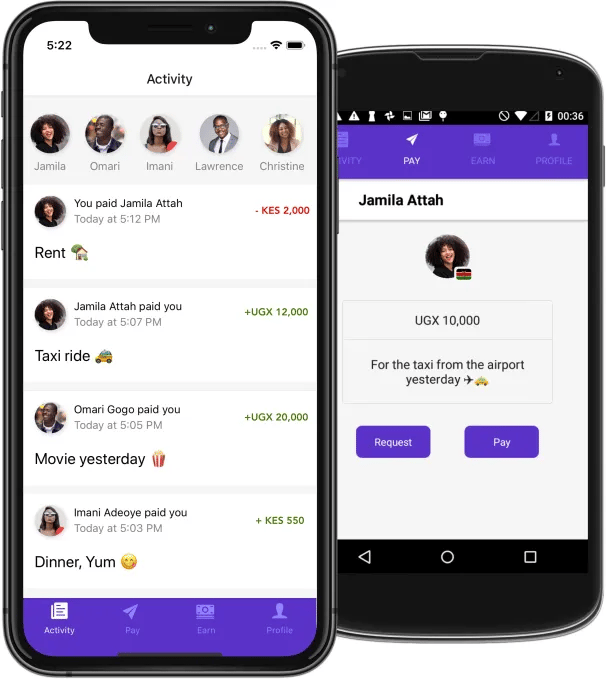

In 2018, Chipper Cash set out to be the African version of Venmo.

It launched a cross-border P2P app starting in Ghana and Uganda.

Chipper Cash was one of the first apps to allow Africans send money across borders for free

Within a year, it hit 600,000 users.

Next stop: continental domination.

In 2019, it moved into three new countries: Nigeria, Kenya, and Rwanda.

Growth came fast. By 2021, Chipper had raised over $300 million, hitting a $2 billion valuation and 5 million users across six African countries.

Then came the roadblocks.

In July 2022, the Central Bank of Kenya (CBK) stated publicly that Chipper Cash was not licensed to operate as a fintech in Kenya.

It ordered local banks to stop dealing with them and close their accounts.

Overnight, operations paused, and millions were frozen in Kenyan accounts.

Today, Chipper Cash is still waiting to get licensed by the authorities and can’t operate in Kenya.

It’s lost thousands of users in the process.

And it’s not alone.

Jumia, spent its way into eight African markets, raising over a billion dollars before going public.

But in reality, it was fighting battles: building logistics infrastructure where there was none, and operating unprofitably for years.

In late 2024, it exited two major African markets, South Africa and Tunisia, to focus on profits.

After a string of operational cuts, Jumia is now closer to profitability than ever before

These stories show that expansion across Africa is a minefield.

What worked in one country may not work in another.

And the companies that actually scale across Africa have to throw away old playbooks and reinvent new ones.

But it also requires meeting the right people and getting the right insights to scale.

So, last month we gathered the people who’ve scaled companies across Africa for one tell-all event.

The Tech Safari Summit

Last month, we hosted the Tech Safari Summit in Nairobi: a gathering for 150 expansion professionals who’ve scaled companies across the continent.

People like:

Amandine Lobelle, Country Manager, Paystack Kenya

Larry Cooke, Head of Legal Africa, Binance

Wiza Jalakasi, Director of Expansion, EBANX

Attendees at the summit include experts from some of the world’s biggest companies

At Tech Safari, we help companies with the expansion question all the time.

And the Summit was the perfect opportunity to gather insights on how to expand from experts at these companies doing the work.

We started on stage, where a panel of expansion leaders gave talks on different expansion topics.

Some discussed the future of payments, while others discussed hiring across borders and navigating policy.

Then, we put out a survey to everyone, starting with a simple question: “What’s your biggest expansion hurdle?”

The Summit was an exclusive event with handpicked operators and expansion leads from across the world

We then asked them to rank the different expansion hurdles they’d faced by difficulty.

Over 70 people responded, most of them being domain experts from companies like Yango, Binance, pawaPay, VertoFX, BasiGo, and many more.

Then, we went deep.

We created a live podcast booth, where we hosted seven one-on-one deep dives with industry leaders.

We discussed expansion strategies, business models, and pivotal moments that shaped their journeys.

Together, they gave us practical, field-tested points of view on the problems, what worked, what didn’t, and why.

And after pooling together the research data from our surveys, plus the wealth of expansion knowledge shared by experts, we created a report called Africa at Scale.

It’s filled with the best playbooks on how to expand across Africa today. You can get the full report at the end of the article - but for now, here are the top three takeaways.

Hurdle One: Regulation, aka The Law of the Land

Nearly half the room picked regulation and compliance as their top hurdle. And it makes sense.

In Africa, every country has its own rulebook. And sometimes, you’re not dealing with one regulator, you’re dealing with many.

Each one has different timelines, approval processes and rules that sometimes contradict each other.

For instance, Nigeria’s Securities Exchange Commission started to liberalise crypto in early 2024.

That same year, Nigerian regulators arrested a Binance executive and barred local users from accessing crypto websites, leaving crypto companies in limbo.

This conflict was only resolved when a new law was passed in 2025.

In the middle of deadlocks like this, expansion plans stall, time and money get wasted, and value is left on the table.

(L-R): Yoeal Haile, Co-founder, SAVA, Larry Cooke, Head of Legal Africa, Binance, and Zanyiwe Asare, VP & Head of Policy Africa, Yango

As Larry Cooke, Head of Legal Africa at Binance, puts it:

"When you're looking at (the cost of) compliance, the frustration is coming from the top down. When decision-makers are sitting in parliament, this is where the conversation should be started. You have the tax authority chasing a tax mandate... the licensing authority with revenue targets... Hence why you'll end up with two licenses that you need to secure to do business."

And while you might think that no regulation can be a godsend, it isn’t.

Being the first mover in a sector means being the test subject for new laws. Regulators use pioneers to figure out new sectors. And sometimes, they don’t get it all right..

Wangui Mbugua, the General Manager of Uber Eats Kenya said this about Uber’s expansion

“As pioneers in the gig economy, we operated while regulators were still catching up. As a result, this frequently put us at odds with existing regulatory frameworks. So, we had to constantly tweak our business model and scaling approach”

(L-R): Wangui Mbugua, General Manager, Uber Eats Kenya, and Yannick Deza, Founder of Data Bites

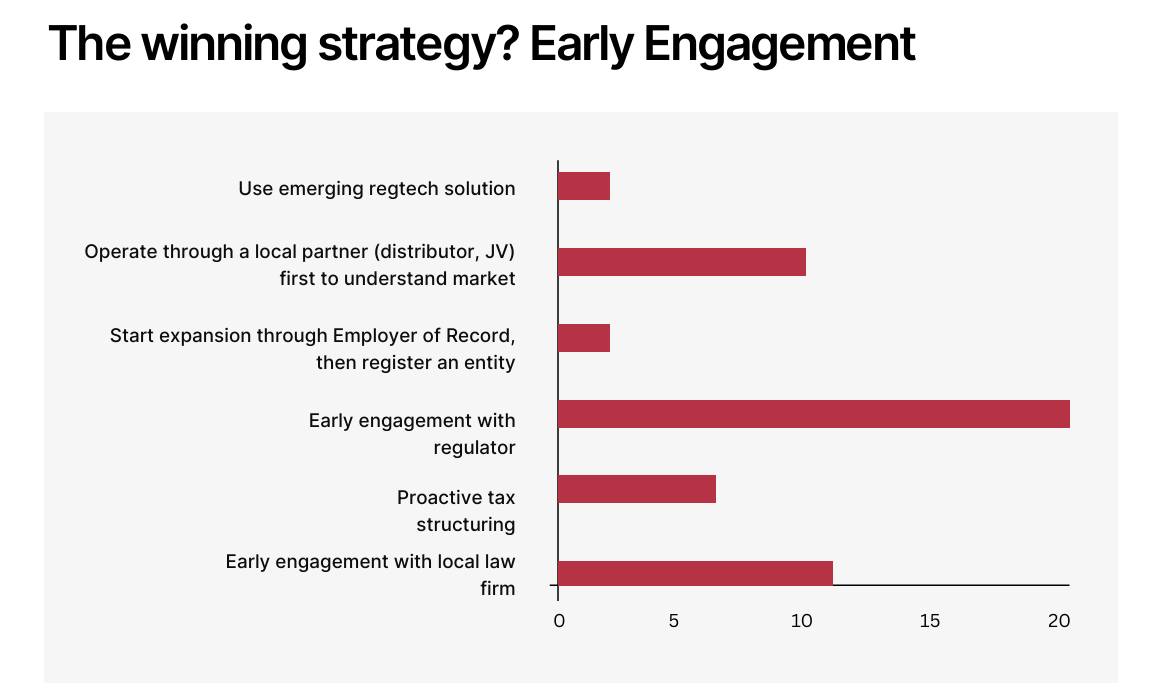

So, what’s the right line to tow with regulation when expanding?

According to experts, the best approach is to treat compliance as a strategy.

This means shifting the mindset from simply getting approvals to playing a full-contact sport with regulators.

Someone has to own the relationships, track changes in regulation, and keep all teams aligned with what policymakers want.

Here’s a snapshot of compliance strategies that work in Africa, as told by expansion experts across Africa

And speaking of relationships, that leads us to our second-biggest hurdle.

Hurdle Two: Talent — Who’s in the Room?

In Africa, every new country is like a new launch.

You’re dealing with new regulators, new players, and an entirely different culture. So, most things, like work culture and standards, don’t just cross over from the HQ.

As a result, the most important hire is the first one in a new country.Their work is much like a founder’s: open doors, build the local team, and get sales.

The gospel says hire a local manager with the credibility, context, and right networks.

Our panelists say…it’s more complicated.

First, you don’t have enough local context to know what skillset you need for a successful expansion.

And because of Africa’s young tech ecosystem, not many people have experience launching your kind of product.

So even when you find a local rising star, it’s hard to know if they’re a strong fit for you.

Paul Breloff, CEO of Shortlist, said it best:

“In the US, you can find someone who’s done the exact thing… that’s very hard to do here… spend more time analysing the humans behind the deal.”

Paul Breloff, CEO & Founder of Shortlist

Hiring the wrong local manager costs time, money, and market share.

So, how do companies find the right talent when they have no local context, and when there’s no time to train local talent on the product?

According to Rebecca Harrison, the CEO of Africa Management Institute, the answer lies in looking within:

“In the tech sector, we love talking about building the rails, right? I think there's a similar narrative around needing to build the rails around people infrastructure. By developing people, our experience has been great when we're able to retain and then promote internally and just get it all done"

As you’d expect, launching in a new market comes with a lot of learning, most of which can’t be done until you’re up and running.

And that’s where the third hurdle shows up.

Hurdle Three: Localisation, the Fit vs. Fracture Problem

Every market has its quirks.

Nigerian users are price-sensitive; South Africans pay for convenience.

So it begs the question, what do you change about your product and what do you keep the same?

If you change too much, your product feels foreign. If you tweak too much, you lose scale.

Elizabeth Njambi, who’s currently an Engagement Manager at FSD Africa, spoke about her experience launching Uber Chap Chap in Kenya, during her time as Senior Marketing Manager at Uber.

When UberX launched in Kenya, it priced its average ride at $5. Despite lots of innovative marketing, users didn’t sign up.

After digging in on what went wrong, they saw that the local transport market, where they hoped to acquire customers, priced the average ride at $0.8.

So they went back to the drawing board and came up with Uber Chap Chap, a cheaper version of UberX that could compete with local taxis.

Uber brought in cheaper, branded cars that could compete with the local taxis and still stay cheap

Spotify is another great example.

After facing stiff competition from local competitors like Boomplay and Audiomack, it repriced its Nigerian plans to fit local incomes.

While Spotify charges $9.99 a month for the rest of the world, it charges as low as ₦1,600 ($1)

Looking at the diverse stories of expansion across the continent, one thing’s clear.

There are many paths to scale

At the Tech Safari Summit, we uncovered lots of hurdles to expansion - but also the best lessons from expansion veterans.

(L-R): Wiza Jalakasi, Director of Africa Expansion at EBANX, Amandine Lobelle, Country Manager at Paystack Kenya, and Andrew Mutha, Managing Director at Safaricom Money Transfer Services

And after piecing our field notes together, we’ve put together six hurdles and twelve takeaways.

In this edition, we dived into a few of the high-level takeaways on what it takes to scale in Africa.

The rest are in our first report, Africa At Scale, which we’ve made available for you to download for free.

It’s filled with data, case studies, and tried and tested recommendations from global companies like Binance, Jumia, Uber, and many more.

If you’d like to read it, sign up here and we’ll send it over.

It turns out that while expansion is the hardest question in African tech, there are answers.

And now, we have the best playbooks for doing it successfully.

If you have insights on expansion that weren't shared in the report, share them with us. We’re keen to hear from you.

Next year, we’re bringing these expanders and experts together again for Tech Safari Summit 2026 - designed to help the best companies scale across Africa faster.

Want to come along? You can request an invitation here.

How We Can Help

Before you go, let’s see how we can help you grow.

Get your story told on Tech Safari - Share your latest product launch, a deep dive into your company story, or your thoughts on African tech with 20,000+ subscribers.

Partner on an upcoming event - You and 200+ of Africa’s top tech players in a room together for an evening.

Hire the top African tech Talent - We’ll help you hire the best operators on the continent. Find Out How.

Invest with Tech Safari - Our private syndicate invest in the most exciting early stage startups in Africa.

Something Custom - Get tailored support from our Advisory team to expand across Africa.

That’s it for this week. See you on Sunday for a breakdown on This Week in African Tech.

Cheers,

The Tech Safari Team

PS. refer five readers and you’ll get access to our private community. 👇🏾

What'd you think of today's edition? |

Wow, still here?

You must really like the newsletter. Come hang out. 👇🏾