- Tech Safari

- Posts

- Following the Money

Following the Money

African tech raised $3.8 billion last year. Where did it all go?

Hey everyone, Sheriff here 👋

For a long time, the health of Africa’s tech market has been judged on capital.

Being a serious startup meant you’d raised money. The more you raised, the more successful and exciting you seemed.

And no year was more exciting for African tech than 2021.

Just look at a few headlines from that year:

Chipper Cash raised $150 million in Series C.

Flutterwave raised $170 million in Series C .

And Andela raised a $200 million Series E from Softbank that made it a unicorn.

In total, African tech companies raised $4.65 billion that year.

The ecosystem has been chasing that high ever since.

The last few years have been sobering.

In 2023, funding tanked to $3.2 billion. Then it tanked even lower to $2.8 billion in 2024.

Some worried if 2022 would ever happen again. Others debated whether venture capital was even right for Africa.

In 2025, we got answers to these questions and many others.

Briter, a market intelligence platform focused on emerging markets, just published its Africa Investment Report for 2025.

They tracked every disclosed dollar and some of the undisclosed dollars that went into African startups in 2025: where they came from, where they went, and what form they took; equity, debt, grants, concessional capital, the whole stack.

And Tech Safari (yours truly) got a look inside it.

The summary is: the good days are back. But the bigger story is, this is no longer 2021.

In this edition, we’re pulling out the highlights. The good, the bad, and the unusual.

But more importantly, we’ll tell you what it all means for Africa in 2026.

Let’s start with…

The Headline Numbers

In 2025, African startups raised $3.8 billion.

That’s 32% higher than 2024, when startups raised $2.8 billion.

And it brings the total funding raised by African startups from 2016 to date to $28+ billion.

African tech startups raised $3.6 billion in disclosed funding in 2025, plus an additional $200 million in undisclosed but tracked funding.

But the composition matters more than the total.

Many companies aren’t raising pure equity anymore; capital is more nuanced than that now.

Here’s the clean breakdown:

Equity still leads the stack.

But debt is now a growing option.

And grants and blended capital quietly funded big parts of the ecosystem.

Briter tracked over 635 deals that were publicly disclosed. Plus an extra 365 deals that weren’t.

The number of disclosed deals in 2025 jumped by 43% from 2024.

But this time is different.

In 2025, we saw smaller cheque sizes on average, especially at the early stage, but not fewer companies.

And the big tickets are increasingly going to fewer, bigger, and more established companies.

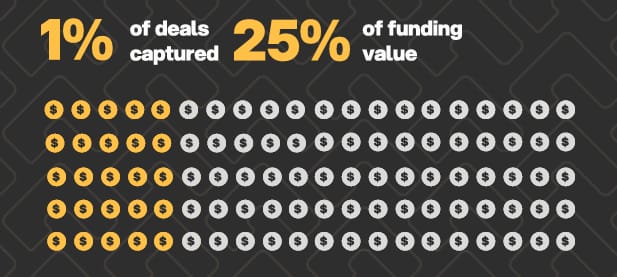

25 cents of every dollar that went into African startups this year was raised by 1% of deals

The recovery didn’t bring back excess; it brought back activity and maturity. And that distinction matters, because it means we’ve quietly set a new baseline.

And it makes sense.

After the 2022 peak, growth and late-stage capital pulled back hard.

Valuations reset. Investors stopped rewarding growth at all costs and started focusing more on revenue and unit economics.

So yes, you’d be hard-pressed to find wild valuations.

But that doesn’t mean it’s harder to raise now.

More companies raised money in 2025 than during the peak years, even though they got less money on average.

So, the market didn’t shrink. It simply sobered up.

Besides sobriety, we saw another big trend.

Africa’s funding map is getting bigger

If this were Africa 2025 Funding Wrapped, the playlist wouldn’t surprise you.

The same four countries would still top the charts: Nigeria, Kenya, Egypt, and South Africa.

Together, they absorbed roughly 85–90% of total funding from 2025, just like they have for the last decade.

But this time, the distribution is interesting.

Nigeria raised the least funding among the Big Four in 2025.

Historically, Nigeria has always either topped the charts or come second, except for 2023, when it came in third.

It’s not hard to see why this has happened, though:

Nigeria’s 2023 currency devaluation made it harder for startups to generate dollar returns.

Fewer mega-rounds happened in Nigeria, making the totals lower.

Its funding charts were dominated by newer, upcoming names in 2025.

This is proof that when it comes to funding, macros matter. But it’s also a sign that the ecosystem is maturing.

Beyond the Big 4, though, Africa saw many breakout markets in 2025.

These are markets like Senegal, Ghana, Morocco, Tunisia, Rwanda, Tanzania, Uganda, and Côte d’Ivoire.

They accounted for 38% of deal count in 2025, the highest share in a decade.

And they all showed steady deal flow across fintech, agtech, health, renewables, and mobility.

This shift makes one thing clear: Africa’s tech map is getting bigger, even though many markets are still underdogs.

And the biggest underdog of them all is Francophone Africa

Francophone Africa is structurally different.

Most of its countries share the same language, the same currencies, and similar regulatory climates.

Yet, none of its markets are among the biggest on the continent.

So the region barely makes the headlines.

But it’s growing fast, with Senegal, Rwanda, and Côte d’Ivoire leading the pack.

From 2016 to date, startups headquartered in Francophone Africa have raised ~$2 billion across 480+ deals.

The deal count says there’s a lot of building going on.

In the future, we’ll likely see more breakout companies from the region.

Like Djamo in Côte d'Ivoire, and Kasha and Ampersand in Rwanda.

Sectorally, the big focus areas are agriculture, agtech, fintech, and healthcare.

Francophone is also different in the kind of funding that hangs around.

Most of it is tied to development or infrastructure. And it’s not uncommon to see the biggest raises come from that space.

Big names like Agroserv Industry, African Healthcare Network, and WeLightAfrica had their funding come from these players.

Beyond geography, something unusual happened about where funding went in 2025.

Fintech is no longer king

The story of African tech funding has largely been a fintech story.

Between 2016 and 2024, fintech dominated African startup funding.

Spaces like payments, lending, and financial infrastructure created unicorns like Wave, Flutterwave, and Moniepoint.

And these companies raised big bucks on the path to scale.

But over the last few years, fintech’s status has been shaky.

It still gets a big chunk of the funding, but its share of the total is declining.

But that’s not to say that fintech as a trend is waning. Instead, other sectors are simply absorbing serious capital.

Which brings us to the real rising star of 2025: Cleantech

This sector recorded the fastest growth on the continent, raising more than three times its 2024 total.

Fintech’s share of the total shrunk in 2025, even though it still came out on top

But the way money went into this sector is different from others.

Typically, VCs invest in high-growth companies in exchange for equity.

But this time, the climate sector is raising more blended capital. There’s a mix of debt and equity.

And the funding sizes and sources are from infrastructure funders.

In 2025, solar energy emerged as the top-funded category, raising $1.2 billion in total.

Top products in 2025 by funding volume

Investors prioritized cleantech models with predictable, "utility-like" returns.

At the same time, agtech has become the silent recipient.

While total funding in the sector declined slightly, deal activity remained stable.

The money is moving away from experimental "on-farm" tech and toward the hard plumbing of food systems: logistics, marketplaces, and distribution.

In fact, in sectors like agtech, debt has now risen to nearly a third of total capital, signaling that the industry is moving from venture-style growth to asset-backed reality.

So, we’ve seen the numbers change in 2025. But we’ve also gotten answers to some old, important questions.

What questions did African tech answer this year?

Where are the exits?

Investors have long viewed exits as the Holy Grail of African venture.

In 2025, we saw a record year for mergers and acquisitions: The continent saw 63+ announced acquisitions in 2025, a 69% increase from the previous year.

Half of these transactions were startups buying startups.

Better-capitalized players like Moniepoint and Stitch used acquisitions to immediately scale, secure regulatory licenses, and enter new markets.

But while M&A volume is up, the "mega-exit" (like a massive IPO) remains rare.

What’s the future of AI in Africa?

AI moved from the margins to the horizontal center of the innovation economy.

Use cases are clustering around credit scoring, fraud detection, and medical triage.

Activity is heavily concentrated in the "Big Four" hubs (South Africa, Kenya, Egypt, and Nigeria) where there is better access to the datasets and cloud infrastructure needed to run these models.

In 2026, we can expect AI to move beyond "chatbots" and into deep operational layers in logistics and enterprise software.

Are we back to the good days?

Yes, but the "good days" look a lot different than they did in 2021.

In 2025, African startups raised $3.8 billion, a 32% increase from 2024.

While the volume is back up, the "growth at all costs" era is over.

Also, debt is sexy now.

For the first time in ten years, debt surpassed $1 billion in annual volume.

This means founders are becoming more capital-efficient and using non-dilutive ways to scale infrastructure-heavy businesses.

And finally, the average deal size (excluding mega-deals) reached its highest level since 2018.

This signals a leaner, wiser ecosystem that is no longer chasing "unicorn" status but building for sustainability.

There’s more to see and more to unpack from Africa’s funding landscape in 2025.

To dive into it, you can read the full report here.

Tomorrow, Tech Safari is hosting a webinar with Briter to dive into the report with some of the continent’s biggest investors.

How We Can Help

Before you go, let’s see how we can help you grow.

Get your story told on Tech Safari - Share your latest product launch, a deep dive into your company story, or your thoughts on African tech with 60,000+ subscribers.

Create a bespoke event experience - From private roundtables to industry summits, we’ll design and execute events that bring the right people together around your goals.

Hire the top African tech Talent - We’ll help you hire the best operators on the continent. Find Out How.

Something Custom - Get tailored support from our Advisory team to expand across Africa.

That’s it for this week. See you on Sunday for a breakdown on African tech.

Cheers,

The Tech Safari Team

PS. refer five readers and you’ll get access to our private community. 👇🏾

What'd you think of today's edition? |

Wow, still here?

You must really like the newsletter. Come hang out. 👇🏾