- Tech Safari

- Posts

- Powered by Airtime

Powered by Airtime

Africa has a digital currency that predates Bitcoin

Hey, Sheriff here 👋

Did you know that ten years before Bitcoin was created, Africa already had a digital currency?

And it’s still in use today, even in the most remote parts of the continent.

This week, we’re talking about that currency.

But first, we have something to share…

Who’s building infrastructure for new African founders?

Building startups is not just about raising money anymore.

Africa’s next wave of founders need infrastructure—tools, systems, policies, and people that actually help startups scale.

So, together with Itana, we’re hosting a live convo on Thursday, August 21, by 11 AM WAT / 1 PM EAT with folks who are building exactly that.

Join Iyin Aboyeji—Managing Partner at Accelerate Africa and co-founder of Flutterwave & Andela—and Nkechi Oguchi, Chief Community & Marketing Officer at Itana, in conversation with Tech Safari’s own Caleb Maru.

This one’s for the builders, the backers, and the curious.

Now, on to this week’s story….

There’s an ancient currency in Africa that’s not issued by governments.

And no, it’s not crypto.

It’s not tied to banknotes, money supply or inflation.

And for every two minutes you spend reading this article, at least $20,000 worth of it will be spent.

It’s called airtime—a word that means different things in different parts of the world.

In the West, it’s an old-school term that belongs in a radio booth.

In Africa, it’s how we make the most of mobile phones on the continent.

Africa has 855 million mobile phone connections

But since we like to start things at the beginning, we have to ask: where did it come from?

Everything good starts in the 90’s

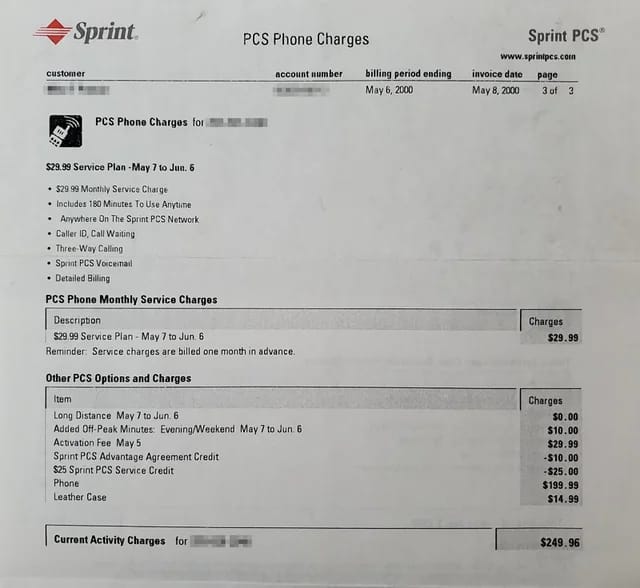

See, back in the 90s, when the mobile revolution was starting off, people paid for phone bills like every other utility.

You talked to anyone, anytime. And at the month’s end, you get a bill.

Just like you’d get one for gas, water or electricity.

This is a real cell phone bill from a US resident, around 25 years ago.

By the late 90s, when telcos started springing up in Africa, they realised something really early on: this model wouldn’t work.

Africa is a low-income continent.

At the time, the average person in sub-Saharan Africa earned around $100 a month, mostly through informal jobs.

So if everyone made calls freely and paid later, most people would end up with expensive bills that are hard to pay off.

For instance, with the government-run telco in Kenya, phone calls used to cost around KSh 25 (45 cents) per minute.

So a 10-minute phone call would cost you almost $5, or 5% of your monthly income.

So, when private telcos launched in Africa, they invented a new mode of payment called airtime.

It was just like cash, but for your phone. Whenever you make calls, it gets deducted upfront.

And when you run out, you top it up.

It was simple, cheap, and it came in scratch cards.

These scratch cards played an OG role in Africa’s mobile history.

People could buy airtime in bits. ₦200 here, 50 Kenyan shillings there.

Mobile vendors sprang up selling scratch cards with airtime vouchers to people.

Back then, you could find vendors on the roadside selling vouchers for a living.

As time passed, Africa’s phone usage grew: thanks to cheaper phones and deeper mobile penetration.

And airtime usage also grew with it.

Today, more than two decades later, airtime is huge in Africa.

In the first nine months of 2023, over ₦2.6 trillion (~$6.3 billion) was spent on airtime and data

In Kenya, people spend KSh 3.4 billion a month on airtime.

And the average South African spends R132 ($7.4) every time they top up their airtime.

But here’s the wild thing: today, airtime has gone beyond a way to make calls.

When you look closely at what it is today, it becomes obvious…

Africans use airtime like currency

According to the GSMA, over 70% of Africans have used airtime for something other than calls and data in the last five years.

In Cameroon and the DRC, some churches collect tithes in the form of airtime.

In Somalia, people send airtime to relatives in rural areas, who then sell it for cash.

And some African businesses use airtime as rewards for surveys, referrals, and promotional programs.

In Somalia, informal money transfer agents sometimes do airtime-to-cash conversions for people in rural areas

For these people, airtime is familiar and trustworthy, so they can serve as a quick substitute for cash.

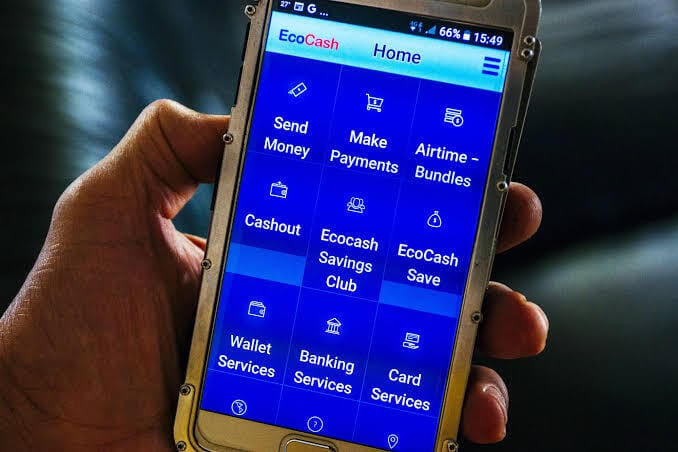

Interestingly, some companies realised this early on. So they started letting people pay for their services with airtime.

In Uganda, you can buy insurance coverage on M-TIBA and MicroEnsure with daily airtime deductions.

In Ghana, betting companies accept airtime credit as a way to stake on predictions.

Airtime is slowly becoming a way to pay for goods and services in Africa.

And the cool thing about it is, it follows a simple truth about Africa that’s hidden in plain sight.

And in 2023, even Apple started letting Africans pay for music subscriptions using airtime.

Africa runs on micropayments

One of the biggest truths about Africa is that everyday products are often unaffordable for everyday people.

As a result, most things are sold in a sachet. It’s called Sachetization.

We wrote about the concept of sachetisation just a few weeks ago. You can read the full article here.

Here’s the non-obvious thing, though: sachet products require sachet payments, or in this case, micropayments.

These are small payments for a specific product, often one that fixes an immediate need.

Whether it’s paying for a bus trip, getting drugs at a nearby pharmacy, or buying dinner.

Africa does a lot of these payments.

M-Pesa processed $450.8 billion last year. Half of them were payments under $10.

Last year, Moniepoint processed $182 billion. The average payment size? Just $20.

Moniepoint processes over 1 billion of these transactions every month

Micropayments are how Africans pay.

It’s clear when you also look at the low uptake of subscription products in Africa.

We’re not a debit-card-every-month economy; we’re a pay-as-you-go continent.

And what makes airtime powerful is that it matches the continent’s rhythm.

It’s the perfect way to pay in an economy that’s built for small, bite-sized payments.

Through the lens of micropayments, the rise of airtime as a currency makes sense.

And tech companies are getting on the train.

But one must ask: what other things can be built on micropayments?

Pay me once, pay me twice

In Lesotho, EcoCash allows users to convert their airtime to cash to pay bills

In Africa, a few things are truly universal. Airtime is one of them.

Tingtel, a bill payments app, lets Nigerians pay for electricity with airtime.

Eneza Education, a Kenyan edtech startup, lets students pay KSh 30 per week to receive lessons via SMS.

But it’s not just local tech companies. Even Apple Music, started letting MTN users pay for their music with airtime since 2023.

These are all digital services consumed by Africans, and paid for with airtime.

And it begs the question: following the logic of micropayments, what else can we pay for with airtime?

What if you could pay for school with airtime, with daily bits of airtime deducted when you show up in class?

Or pay a small sum to stream just your favourite songs and no more?

In a world like this, products that charge differently can earn differently.

Because if there’s anything Africans love, it’s paying for just what they bought.

And paying with airtime helps unlock that experience.

It’s a small design tweak that could have massive implications, and more African companies are starting to adopt it.

Airtime isn’t just a telecom relic. It’s a lesson design.

So, what else do you think we can power with airtime in Africa?

Let me know here.

P.S. Tech Safari is Planting Something Big!

Africa grows the world's favourite crops, but who's growing the solutions to make farming smarter?

That’s what we want to know with our new project at Tech Safari.

From Nairobi rooftop tomatoes to Nigerian AI-powered irrigation, our new project will track the innovations transforming how the continent feeds itself—and the world.

If you’ve ever wondered what a tech revolution looks like when it happens in fields instead of offices, then we’ve got something for you in August!

Join our plot and watch what we grow together.

That’s it for this week. See you on Sunday for a breakdown on This Week in African Tech.

Cheers,

The Tech Safari Team

PS. refer five readers and you’ll get access to our private community. 👇🏾

What'd you think of today's edition? |

Wow, still here?

You must really like the newsletter. Come hang out. 👇🏾