- Tech Safari

- Posts

- Rwanda’s Hidden Engine of Jobs

Rwanda’s Hidden Engine of Jobs

The blueprint behind a $1B ecosystem play

Hey there,

Jefferson Rumanyika here 👋.

I’m taking over Tech Safari this week to explore a riddle at the heart of Rwanda’s economy.

A landlocked country, scarred by history, with few natural resources.

Yet, in just five years, it’s built an export industry that employs over 4,000 Rwandans from scratch and pulls in global giants.

It’s not mining. Not tourism. Not even coffee.

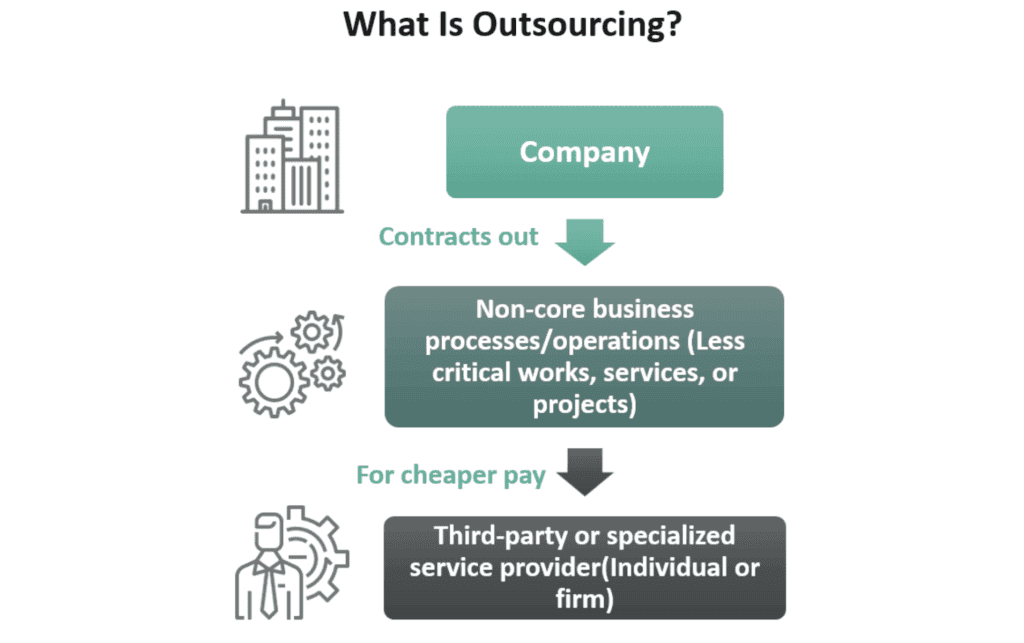

It’s Global Business Services (GBS), the art of handling the world’s back-office grind: customer calls, tech support, HR, finance.

How BPO works. Photo Credit: Join Genius

But here’s the puzzle: Rwanda chased this industry for a decade with zero traction.

Then, between 2019 and 2024, the sector exploded from 2 firms and 100 jobs, to 38 companies and nearly 4,000 roles.

What flipped the switch?

To unpack it, you need to meet the Invisible Man. But before you do…

You're Invited to See the Future of Finance.

What does a $4.9 million bet on African payments look like?

It looks like HoneyCoin's new Nairobi HQ. This isn’t just an office party; it’s an exclusive gathering to celebrate the future of finance in Africa.

Join a curated, invite-only group of fintech leaders, investors, and builders for an evening of connection, live demos, and good vibes on the 19th of September, in Nairobi, Kenya.

Capacity is tight. Claim your spot on the guest list.

Meet the Invisible Man

Just a few years ago, Claude Mutabazi* was invisible.

A 41-year-old man living with his younger brother. He’d become the black sheep of the family.

Quiet. Polite. Unemployed. The kind of man people had stopped expecting much from.

He wasn’t lazy. Nor uneducated. He’d even graduated with a degree in IT.

But in 2020 Rwanda, there weren’t many options for him.

Rwanda had dreams. Vision 2020. Vision 2050. Slide decks galore.

But on the ground in 2020, unemployment had peaked at 22.1%.

Youth were struggling to get into the job market. And for people like Claude who didn’t fit that “youth” bracket anymore, getting a job was much harder.

Then something shifted in Rwanda 2 years ago.

Now, in 2025, Claude Mutabazi wakes up in his own home.

A home he rented with money he’d earned fixing Microsoft crashes. 8,000 miles away. In a call center in Kigali.

He has a housekeeper. And on his days off, he rides his bike through the eco park close to his home.

Even his family sees him differently now. Respect, like capital, compounds.

Claude Mutabazi is not alone.

Like him, thousands of Rwandans have suddenly found themselves part of something bigger. Business Process Outsourcing, or BPO. And its sleeker successor: Global Business Services.

Photo Credit: Rwanda Development Board

It’s the business of doing the world’s office work from somewhere else. Answering calls. Fixing tech glitches. Managing accounts. Running HR. The kind of jobs once tied to corporate towers in London or New York.

Export-grade. Paying in dollars. Fast-scaling.

Now, they’re flowing into Kigali.

Where companies can find skilled workers for a fraction of the cost.

And where people like Claude can turn a headset and a good internet connection into a living.

But Claude’s story isn’t random.

It’s the blueprint

Back in 2010, strategists at the Rwanda Development Board (RDB) eyed India and the Philippines who were raking $5.9 billion and $6.3 billion yearly from the BPO industry.

Rwanda’s goal? Hit $13 million in BPO revenue that year, and scale to $53 million by 2015.

Ambitious. But reality stared them in the face.

The sector was built on empty promises. It created a lot of training opportunities but no real employment.

Investors would arrive on guided tours, showering the project with praise, only to vanish once the cameras were off.

Most Rwandans didn't even know what BPO was.

By 2011, Rwanda’s Ministry of Trade and Industry (MINICOM) took a hard look at the BPO sector and pointed out 5 issues holding the sector back.

There weren’t enough people with the right tech and business skills to fuel the industry.

Most high school and university grads struggled with English and French. A big problem in a sector that’s all about global clients.

Spotty internet and other tech gaps make it hard for local providers to compete or attract serious investors.

Local BPOs often couldn’t get the cash they needed to grow or even keep the lights on.

Many young firms couldn’t even win government jobs. The process was too tough, too closed, or both.

The ministry rolled its sleeves and joined forces with the RDB and other ministries to fix the plumbing that would unlock the sector one by one.

They designed the systems & policy architecture brick by brick.

Skills Gap → Talent Pool

In 2010, Rwanda’s local talent wasn’t job-ready.

ICT programs at the National University of Rwanda and KIST leaned heavy on theory, and were light on practical skills.

The hands-on, certifiable skills employers wanted were still out of reach for most graduates.

So Rwanda made a bet: bring heavyweight STEM institutions to raise the bar.

Carnegie Mellon arrived in 2011.

Carnegie Mellon University Africa in Rwanda. Image Source: Carnegie Mellon

AIMS followed in 2016. New players like Akilah (2010), Kepler (2013), and ALU (2017) joined in.

All part of a grand strategy to close the skills gap.

The result was a conveyor belt of talent. Skilled workers ready to plug straight into jobs.

Language Barrier → Bilingual Workforce.

Pre-2008 Rwanda had a language gap.

Most spoke Kinyanrwanda at home, and French at schools. English was niche.

That changed almost overnight in late 2008 when the government made English the primary language of instruction.

In 2009, Rwanda joined the Commonwealth, pushing French to the sidelines and throwing the country into a decade of linguistic limbo.

It took a decade, but today’s grads? Fluent in English + French, a rare edge.

Weak Infrastructure → Reliable Infrastructure.

In 2010, Rwandans paid about double the regional average for electricity—$0.22 per kWh vs. $0.10–$0.12, because the country wasn’t making enough of its own power.

And ICT infrastructure was still pricey and holding things back.

But that’s changed.

Today, Rwanda generates about 82% of its own electricity, with the rest coming from regional plants.

The Rusumo Hydro Power Plant in Rwanda.

Power costs now range between $0.14 and $0.17 per kWh.

The ICT game has levelled too.

Backed by a 7,000 km fiber backbone, download speeds have jumped from 2.5 Mbps in 2011 to 30 Mbps(on average) in 2025.

And Internet service providers went from just 3 to 57 by 2025.

By the mid-2010s, Rwanda had rewired its foundations: skills, language, infrastructure.

With the basics locked in, the focus shifted from laying bricks to bringing business through the door.

That's when the first wave of BPO players began to trickle in.

Tech Safari x Latitude59 Launch Mixer in Nairobi 🇰🇪

Tomorrow afternoon, we're teaming up with our friends at Latitude59 for their official Kenya launch party.

It's an evening of food, drinks, and connections with Nairobi's tech community ahead of the main December event.

Attendees will get the first look at Latitude59 Kenya 2025 and how we're building bridges between Africa and the world.

The mixer is for anyone wanting to connect meaningfully with the ecosystem before the main edition, and we have a few spots still available.

The first trickle

In 2013, Rwanda pulled in its first BPO player, ISON Xperiences, which set up shop to serve local clients like MTN Rwanda.

But BPO was still a domestic play then. No global ambitions yet.

In 2015, the government doubled down, labeling BPO a high-priority sector to fight unemployment.

But it wasn't until Solvit Africa showed up in 2017, followed by South Africa's Harambee in 2018, that the game really started to shift.

By then, there were plenty of educated youth, but they came with theory, not hands-on skills. So employers had to spend big, training them on the job.

Harambee stepped in with proven playbooks.

They had work readiness programs that turned fresh grads into job-ready hires. They taught the soft skills, work habits, interview prep and English acceleration needed to get youth hired faster.

Youths posing for the Harambee Youth Accelerator. Photo Credit: Harambee

They'd already had success training youth and placing talent in South Africa's booming GBS sector, which employed over 300,000 people.

So, they started training and placing youth for tourism jobs, which was the country's top exchange earner at the time.

Then came 2020. COVID happened. The world stopped, and Rwanda's tourism sector evaporated. This should have been a disaster.

Instead, it became…

The Tipping Point

Before 2020, work meant showing up at the office every day.

Physical presence, not output, was the measure of productivity.

But with COVID, remote work boomed and so did the GBS sector.

Suddenly, global clients were asking: "If we can work from Iowa, why not Kigali?"

A dedicated team at the Rwanda Development Board (RDB) seized this moment.

They realized they couldn't compete on generic points like "young talent."

Instead, they built a case around Rwanda's unique, hard-to-copy advantages:

Clean and Compliant: Low corruption and stable governance.

Bilingual Bargain: A rare source of both English and French speakers at a low cost.

First-Mover Edge: An unsaturated market where companies could shape the ecosystem, not just compete in it.

Reliable Core Infrastructure (Security + Uptime): Low crime (relative to peers), stable electricity, improving broadband. Not 100% plug-and-play yet, but stable than most “upcoming” markets.

This wasn't just a PowerPoint presentation.

The RDB actively pitched over 80 target firms and created a hands-on support system to ensure their success.

Through Harambee, and with partners like Mastercard Foundation and GIZ, RDB launched the Rwanda GBS Growth Initiative, a platform to grow the industry, push for its needs, and build a talent pipeline that delivers.

Stakeholders at the launch of the Rwanda GBS Growth Initiative. Photo Credit: Rwanda GBS Growth Initiative

Most foreign investors had a mental shortlist of countries with booming BPO sectors and Rwanda wasn't on the radar.

So the real work was shifting that perception and closing the information gap.

In late 2021, the first domino fell: TekExperts arrived in Kigali, proving the model worked.

Their success became the ultimate sales pitch, and their country manager personally recruited other firms.

CCI Global came in 2022. By 2024, even Teltech (TTEC), a NASDAQ-listed player, had followed.

The Impact

Today, Rwanda has nearly 3,800 formal GBS workers being paid between $200 and $370 a month for mid-level roles, at least 2x more than Rwanda's average income of $151.

These jobs fuel the economy by pumping more than $5 million yearly back through taxes and social contributions.

One trained worker can repay 3 to 5 times their training cost over a few years, if they stick around.

Rwandan GBS firms aren't just growing. They're scaling fast.

TeKnowledge started with 53 hires in 2021 and now employs 800 people.

CCI Global landed in 2021, grew to 1,200 workers. TTEC entered with 300 seats and is betting big: a commitment to 3,000.

These aren't just numbers. These are now some of Rwanda's largest private employers.

The Jenga Blocks

Rwanda didn't try to copy India.

It didn't overpromise with glossy SEZ pitch decks or smother the sector with excessive subsidies.

It moved like a system designer: starting small, listening hard, and learning fast.

Training → Jobs → Validation → Investment → Policy Tweaks → Repeat

Each part reinforced the next. Not a straight line. A flywheel.

And then, the real magic: emergent behavior.

Anchor firms are now showing up.

Managers are branching off to launch their own ventures.

Institutions start evolving based on what's actually happening, not what someone theorized five years ago.

The whole thing starts acting like an organism—sensitive, adaptive, self-correcting.

For investors, the lesson is this: Narrative leverage hides in small wins. Rwanda turned a 53-person pilot into a continental proof point. The ROI wasn't just capital. It was confidence.

For builders, the insight runs deeper: Trust and coordination are alpha.

In fragile markets, speed and integrity compound faster than dollars.

What do you think about Rwanda's approach to building its ecosystem?

Tell us here.👇🏾

How We Can Help

Before you go, let’s see how we can help you grow.

Get your story told on Tech Safari - Share your latest product launch, a deep dive into your company story, or your thoughts on African tech with 60,000+ subscribers.

Create a bespoke event experience - From private roundtables to industry summits, we’ll design and execute events that bring the right people together around your goals.

Hire the top African tech Talent - We’ll help you hire the best operators on the continent. Find Out How.

Something Custom - Get tailored support from our Advisory team to expand across Africa.

That’s it for this week. See you on Sunday for a breakdown on African tech.

Cheers,

The Tech Safari Team

PS. refer five readers and you’ll get access to our private community. 👇🏾

What'd you think of today's edition? |

Wow, still here?

You must really like the newsletter. Come hang out. 👇🏾