- Tech Safari

- Posts

- This Week in African Tech 🌍

This Week in African Tech 🌍

Inside: A huge profit jump for MTN and Airtel 💰

Hey hey, Darius here 👋🏼, good morning.

In the African tech ecosystem everyone was busy tallying spectacular results this week.

MTN Nigeria raked in ₦750 billion ($518 million) profit, Airtel Africa posted a whopping 375% jump in half-year profit, and Yellow Card won a major global award for solving cross-border payment headaches.

But before we unpack the details…

Tech Safari Mixer - Cape Town 🇿🇦

Hey 👋🏾

We're back in Cape Town on Wednesday, November 12th for another Tech Safari Community Mixer!

If you are a founder, operator, investor, or creator in South Africa's tech ecosystem, join us for a night of:

🎤 Punchy discussions with leaders in Africa's tech space

🤝 Networking and connections

🍿 Great food and drink

✨ A few surprises

Speakers to be announced soon (and trust us, you won't want to miss this lineup 👀)

🎟️ Tickets are capped – Early bird tickets sold out in days, and we're down to the last set of regular tickets at a higher price point. Don't miss out!

Tech Roundup

MTN Nigeria is back with ₦750 billion ($518 million) in profit and a 57% jump in service revenue. Data usage climbed 36%, MoMo revenue soared 72%, and broadband hit 4 million users, giving the company its cleanest growth story in years. The board capped the comeback with a N5.00 interim dividend for shareholders.

MTN Nigeria CEO Karl Toriola

Airtel Africa has posted a 375% jump in profit for the first half of 2026, powered by booming data use and mobile money. Data is now its biggest business, pulling in $1.16 billion, while mobile money payment volume crossed $193 billion. The company added millions of new users and now runs 38,000+ sites, 98.5% of them on 4G.

Nigeria’s Access Holdings has agreed to pay $109.6 million for the National Bank of Kenya, giving it a ready-made network in East Africa’s biggest banking market. The lender is still finalising payment, with AFREXIM stepping in to guarantee most of the bill, while its Kenyan arm continues to post losses.

DStv’s new owner, Canal+, is wasting no time tightening the screws. The company has reportedly frozen supplier payments and asked for 20% invoice cuts, leaving hundreds of bills sitting unpaid. MultiChoice says it’s all part of a long-running efficiency push, but the Competition Commission is already eyeing whether the new regime is breaching merger conditions.

Off-grid solar giant Sun King is bringing production home, starting with a new Nairobi plant that’ll assemble hundreds of thousands of solar TVs and phones annually. The move trims long supply chains, lowers costs, and builds on the company’s rapid growth; it now ships 330,000 solar kits a month, up from 10,000 in 2017. A $156 million loan package is fueling the expansion, with Nigeria slated for the next factory.

Executives at the opening of the new Nairobi plant. Image Source: Sun King.

Western Union is rolling out USDPT, a Solana-based stablecoin designed to win back ground in Africa’s $95 billion remittance market, where fintechs and crypto apps have been nibbling at its fees. The company moves over $100 billion globally each year and says stablecoins are simply “the next evolution” of money movement.

Flutterwave, which processes $40 billion+ across 34 markets, is making a big blockchain swing by adopting Polygon as its settlement rail for stablecoin payments. The partnership promises instant, low-cost transfers in a region where cross-border fees are among the world’s highest. If it works, stablecoins could quietly become the plumbing behind Africa’s business payments, starting with enterprise clients like Uber and Audiomack.

Safaricom-backed M-Tiba has reportedly been hit by one of Kenya’s biggest-ever data breaches, with hackers claiming they stole over 17 million medical and personal files. A group called Kazu posted a 2GB sample that appears to show patient names, IDs, diagnoses, and billing records from more than 700 health facilities.

Yellow Card picked up the Grand Prix Payments Award at Money20/20, putting the African fintech company in the same winner’s circle as Mynt, ZeroHash, and Ant Group. The company was recognized for its work making cross-border payments less of a headache across the continent.

Deal Roundup

Novastar Ventures secured a $200 million boost from the Green Climate Fund to scale climate-tech solutions across Africa. The new fund will target early and growth-stage companies working on clean tech, adaptation tools, and other planet-friendly innovations. It’s a small but meaningful dent in Africa’s $2.8 trillion climate funding gap, and a push to turn the continent into a climate-tech powerhouse.

Enzi Mobility secured $3.5 million from Kula PCC to speed up its e-motorbike rollout and expand its battery-swap stations. Alongside the funding, Enzi will introduce two blockchain tokens—$ENZI for governance and $BODA for rider perks—to give its community more ownership in the company’s growth. The startup calls it a win for cleaner, cheaper transport across the region.

Velents.ai raised $1.5 million to launch Agent.sa, an Arabic-speaking AI “employee” that can answer calls, chat on WhatsApp, analyze data, and handle customer requests like a human colleague. The Egypt-born startup pivoted from recruitment tech to enterprise AI last year and now claims Agent.sa plugs into 20+ systems across industries. Investors include execs from Google and BCG, betting that Middle Eastern businesses might soon hire silicon staffers alongside human ones.

Kenya’s Synnefa secured a $300,000 grant from P4G to deploy connected solar dryers that speed up crop drying from weeks to 2–3 days. The move is set to support 800+ farmers in Makueni County, reducing losses and boosting yields across coffee, grains, fruits, and vegetables. With ambitions to reach 150,000 farmers by 2026, Synnefa wants smart farm tech to be the region’s new defense against food waste.

Nedbank has gotten the all-clear to buy iKhokha, the Durban-based fintech that helps small businesses accept card payments and access cash advances. Regulators approved the deal with zero conditions, saying it won’t dent competition. The move gives Nedbank a stronger foothold in South Africa’s fast-growing digital payments space, and puts extra pressure on rivals like FNB and Standard Bank.

Events

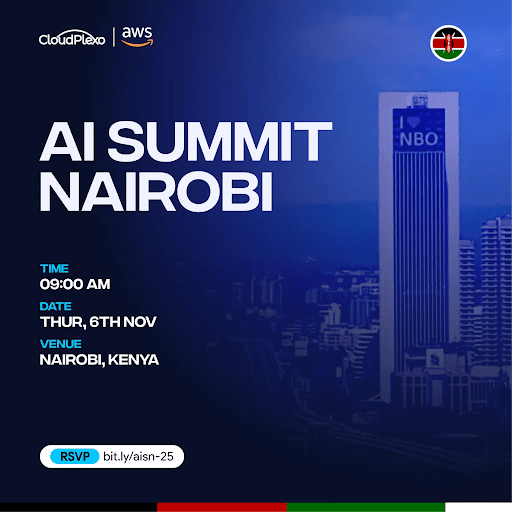

Be part of the conversation shaping the future of Artificial Intelligence in Africa. The Nairobi AI Summit will be held on Thursday, November 6, 2025, and will bring together tech leaders, innovators, and enterprises exploring how AI is transforming industries, driving efficiency, and unlocking new opportunities across the continent. Register Here.

💼 Jobs of the Week (Talent Safari & Shortlist)

Tech Safari is proud to have built Talent Safari in partnership with Shortlist. Talent Safari is our trusted hiring service, helping innovative companies across Africa find high-quality vetted mid-level talent for their teams. Shortlist is Africa’s leading executive search firm, supporting end-to-end leadership hiring in Africa and beyond.

Each week, we will feature some of the most exciting jobs from Talent Safari and Shortlist in this newsletter.

Talent Safari - Job Board - Featured Mid-level Roles:

⚡💵Kuunda- Operations Manager - Dar es Salaam

💡CatalyzU- Fullstack Engineer - Cape Town

🖥️ Kitsilano Technologies - Account Executive – Cloud Solutions - Nairobi

🍈Jackfruit Finance - Commercial Manager - Nairobi

🎓Craydel - University Partnerships Manager - Nairobi

🛒Taager - Strategic Finance Manager - Cairo

🧩 Advance Insight - Growth Lead - Nairobi

🍑 Peach Payments- Engineering Manager x 3 - Cape Town, Johannesburg, Nairobi, Mauritius

Shortlist - Job Board - Featured Executive Roles:

🌍 Jacobs Futura Foundation - Programme Manager - London

💼 Gatsby Africa - Communications Director - Nairobi, Kenya

Are you a leader who wants to find great talent for your team with Talent Safari or Shortlist? Get in touch through links below:

And that's a wrap!

That’s it for this week. See you on Wednesday 😃

Cheers,

The Tech Safari Team

How We Can Help

Before you go, let’s see how we can help you grow.

Get your story told on Tech Safari - Share your latest product launch, a deep dive into your company story, or your thoughts on African tech with 60,000+ subscribers.

Create a bespoke event experience - From private roundtables to industry summits, we’ll design and execute events that bring the right people together around your goals.

Hire the top African tech Talent - We’ll help you hire the best operators on the continent. Find Out How.

Something Custom - Get tailored support from our Advisory team to expand across Africa.

PS. refer five readers and you’ll get access to our private community. 👇🏾

What'd you think of today's edition? |

Wow, still here?

You must really like the newsletter. Come hang out. 👇🏾