- Tech Safari

- Posts

- Where’s the Liquidity?

Where’s the Liquidity?

Africa’s capital pipes are clogged

Hey there, Sheriff here 👋

This week, we’re talking about money, AKA capital.

See, money makes the world go round. But it can also do so much more: start companies, run countries and save lives.

The only thing is, it’s always on the move…except in Africa.

But before I tell you what’s holding Africa’s bag…

Now, on to this week’s story….

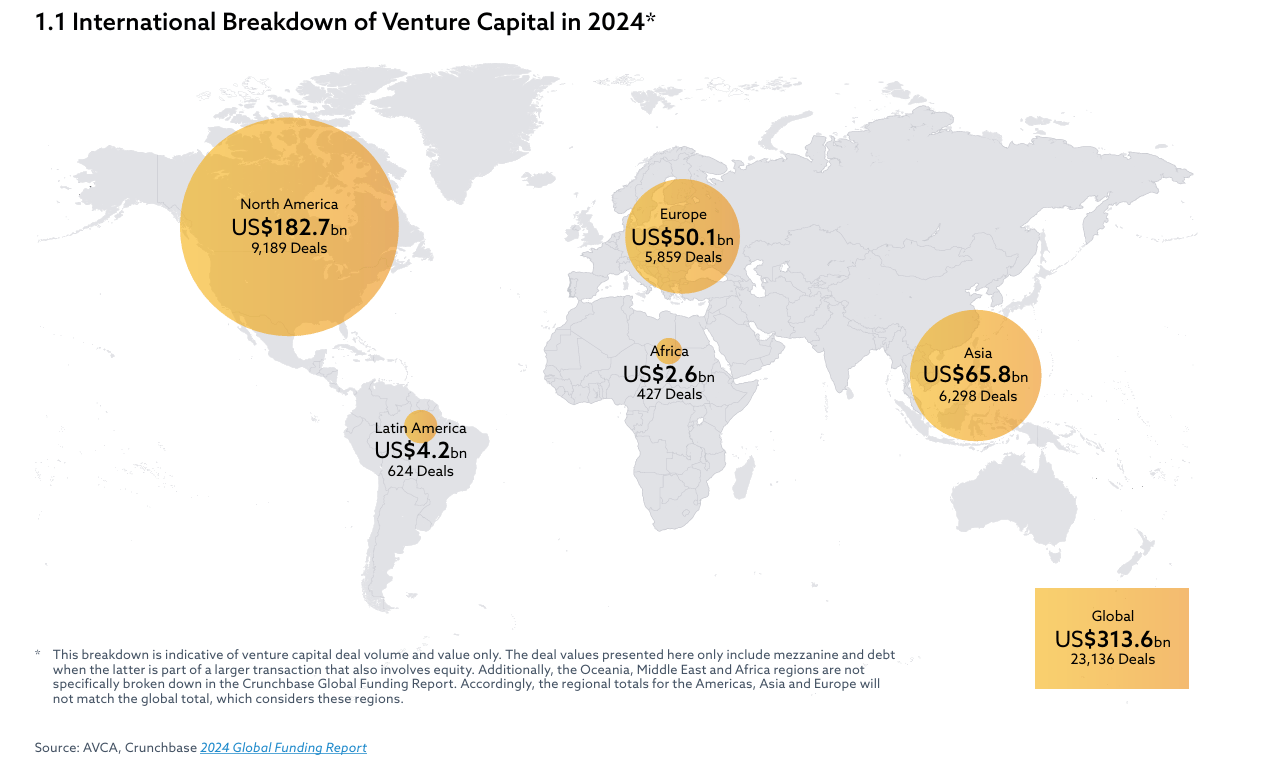

0.8%.

That's Africa’s share of the world’s venture capital funding in 2024.

It’s roughly $2.6 billion, and most of it went into funding the biggest, most transformative companies you know.

Names like Moniepoint, TymeBank, and Moove.

But when you compare that to the $314 billion raised globally last year, it’s hardly a drop in the bucket.

For every dollar of venture capital spent in the world, Africa gets less than a cent. Image Source: Crunchbase

But here’s the wild part: it’s not just venture capital that’s low in Africa, it’s all capital.

It’s because Africa’s capital pipes are clogged.

And to understand why, we first need to understand Capital Markets.

Sell me the money

See, capital (AKA money) is just like any other commodity.

It can be sold, bought, lent, used, and priced.

The buying and selling happen in what is called capital markets, and these come in two forms: public and private.

The public markets are the ones you know, like the New York Stock Exchange and the London Stock Exchange.

It’s where anyone can buy a piece of their favourite listed company, like Amazon, NVIDIA, and MTN.

This is the New York Stock Exchange in the 1980s. Before computers took over, people used to buy and sell stocks by screaming prices on a trading floor just like this.

On the other hand, private markets are where a select group of investors and companies can participate, like venture capital and private equity.

Now, here’s the thing.

Africa’s private capital markets are having a good time.

2024 saw over $4 billion in private capital (VC and PE) raised by investors.

The number of exits is up by 47% since last year.

And more than $10 billion in uninvested capital sits with investors across the continent.

In theory, this should = a growth in funding, right?

But in reality, it isn’t.

The Plumbing Theory

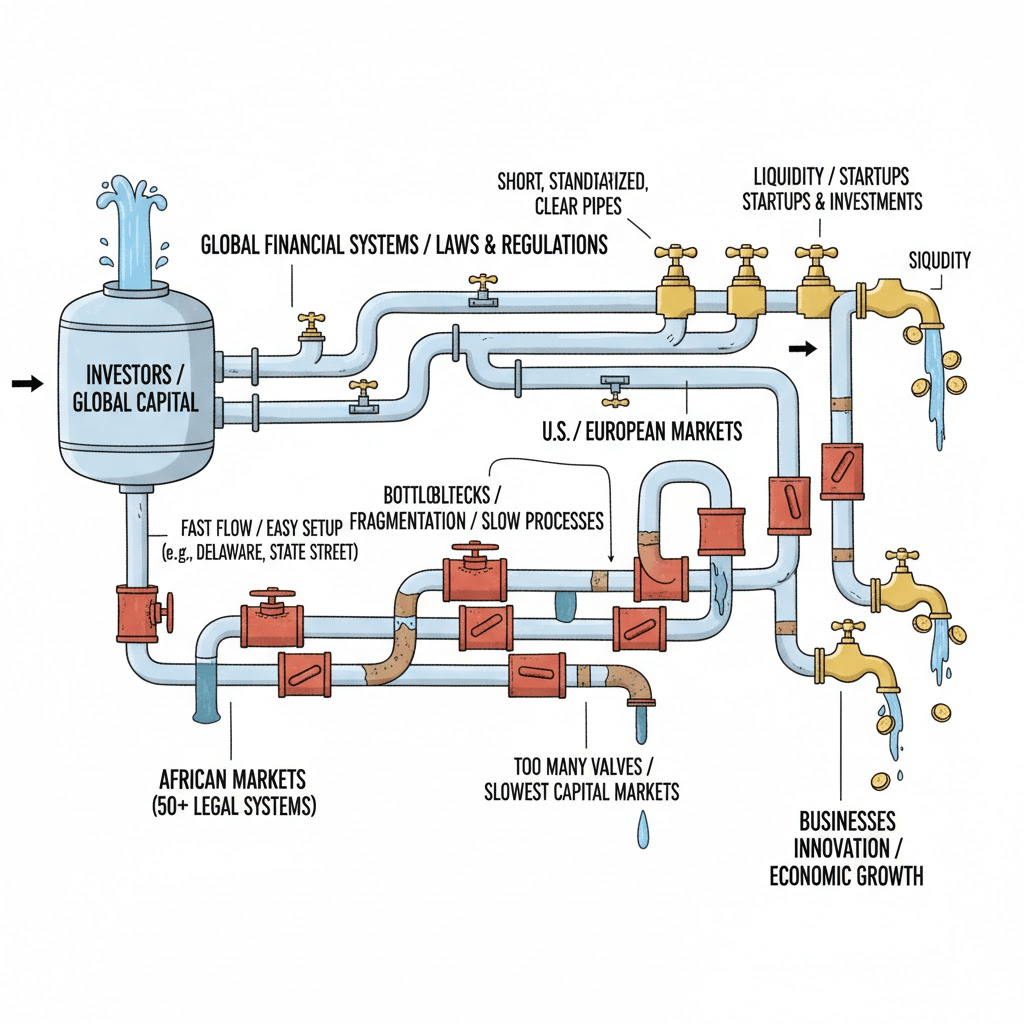

Let’s think of capital as water flowing through a house.

The water has a source, flows through pipes, gets stopped by valves, and is released through taps.

The speed of the water depends on what kinds of pipes you use:

Are they thin or wide?

Are they long or short?

Are they clogged or clear?

And are there too many valves slowing down the flow along the way?

Capital works in the same way.

The investors are the source.

The velocity of water moving through the pipes is called liquidity, i.e how quickly money moves around.

The pipes are the systems making this all happen: laws, workflows, documents, and financial systems.

Africa has bad capital plumbing, and it impacts everything from fundraising to exits.

In the U.S. or Europe, those pipes are short, standardised, and mostly clear.

You can set up a company in Delaware or Luxembourg in a few days.

You can raise and manage capital easily through State Street.

And you can use world-class software to sign documents and track ownership.

In Africa, the pipe is long and fragmented across many 50+ legal systems, with too many valves that act as bottlenecks.

Africa’s capital markets (both public and private) are some of the slowest on Earth.

KPMG found that thanks to the perceived riskiness of Africa, deals take much longer to close here.

So, that $10 billion in uninvested capital that sits with investors across Africa?

It’s money stuck in slow systems.

In 2023, Nigeria blocked over $850 million in revenue that airlines had earned but couldn’t repatriate.

In 2023, global airlines stopped flights to and from Nigeria because they had no way of getting their money out of the country

And that year alone, Nigeria had $7 billion worth of uncleared requests for foreign currency.

These are symptoms of a bigger issue: African capital markets have the lowest liquidity in the world.

The question is…

What’s clogging the pipes?

Three main things clog Africa’s capital pipes.

First, the legal structures.

Many African company laws are designed for simple equity: one share, one class, one vote.

In VC and PE, though, investors want “preferred shares”, which come with special rights on voting and company sale.

Without the legal support for this, they’re left finding workarounds, and deals get harder to execute.

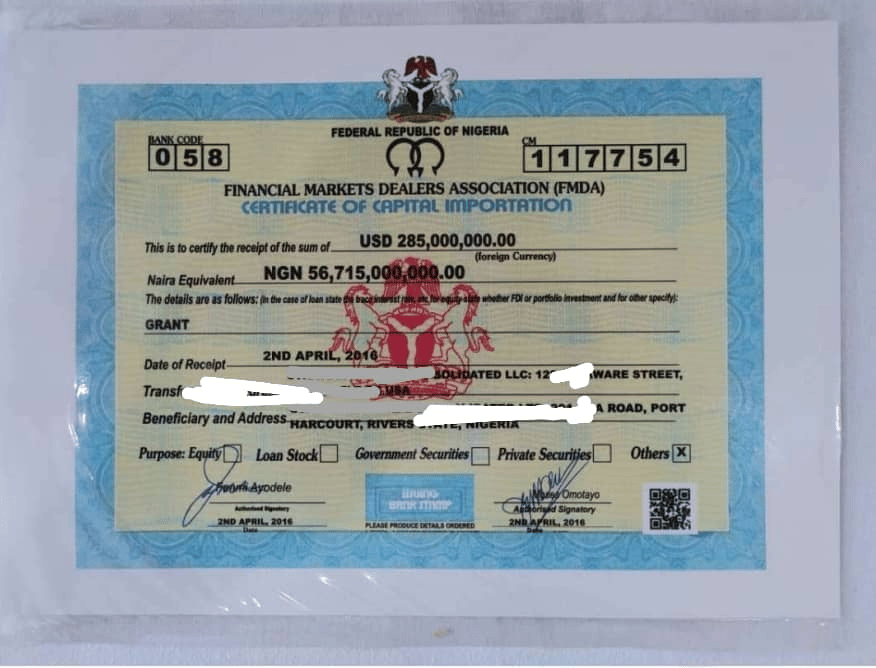

The second is currency restrictions.

PE funds tend to hold shares in local currency. But since they have global investors, they need foreign currency after an exit.

Getting this requires jumping through hoops, like bank approvals and scarce currency markets.

In Nigeria, returning funds to investors abroad requires you to prove that the invested capital came through legal means in the first place. To do this, you need to get a Certificate of Capital Importation (CCI). It’s not uncommon to wait months for this to get approved.

It’s why 62% of fund managers say they face currency issues during exits.

When cash can’t move out easily, investing becomes riskier for global investors.

Last is unmatched expectations.

The global average time to exit for most PE deals is 5 to 7 years.

In Africa, it’s 6.4 years and can extend to 8, thanks to Africa’s thin exit market.

When you add the time taken to get hard cash to investors, it gets even longer.

Most global investors expect to be repaid in ten years. But these prolonged exit periods make it hard to reach that goal.

The result? Investors are hesitant even to start investing.

Africa has fundraising momentum. But these plumbing issues are slowing it down.

But fortunately..

The plumber’s here

In 2012, Henry Ward was a Finance grad in New York, building a fancy Wall Street-style trading tool. Nobody signed up.

One night, a friend told him, “Forget traders. Help startups track their ownership.”

So he built eShares.

It was a simple idea: put a company’s ownership records online instead of on paper.

Investors didn’t like it at first, because it gave everyone the same information on a deal. But that was the point.

Soon, eShares could see everything: who owned what, how much companies were worth, and how money moved into companies.

In 2017, eShares became Carta.

Henry Ward, Co-founder and CEO of Carta

And over time, it grew beyond tracking company ownership.

It helped companies set share prices, run their investor paperwork, and even let employees sell some of their shares for cash.

Today, Carta is the market-leading platform for managing equity.

It’s raised over $1 billion, makes around $500 million a year, and tracks about $4 trillion worth of company ownership for 50,000+ companies and 8,500+ investors.

But, as you can expect, Africa wasn’t plugged into that plumbing.

Until now.

In 2025, Carta hired Marvin Coleby, who had built Raise, a homegrown tool helping African startups track ownership.

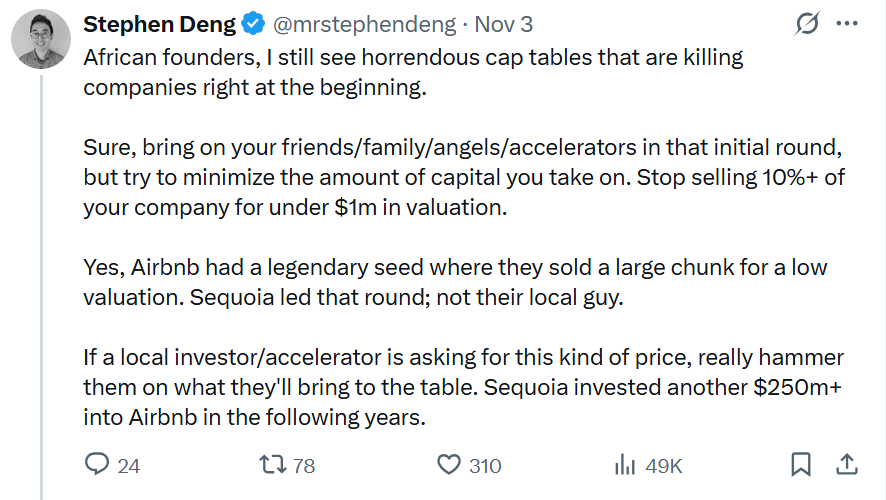

Stephen Deng, a GP at DFS Lab, brings up Africa’s cap table problem, linked to poor visibility over equity ownership.

Raise proved that founders on the continent needed better systems, but it couldn’t plug directly into the big global money pipes.

Carta can. And now, it’s bringing its full toolkit to Africa.

For founders, it makes it easier to track who owns what and raise money without juggling ten Excel files.

For investors, it makes it easier to set up funds, send money in, and get money out.

Put simply: Carta’s trying to be Africa’s capital plumber, connecting our systems with global investors.

With the hope that

Capital moves at the speed of trust

Carta isn’t bringing in new money, just better plumbing.

And that’s an unclog in itself.

Liquidity flows when the pipes are clear.

Carta recently worked with PowWater, a Kenyan social enterprise that delivers clean water to communities at the touch of a button.

After PowWater's first funding round, Carta came in to help it set up a clean cap table that was easily accessible.

Investors could see their holdings whenever they wanted. And employees could log in to Carta and watch their equity vest in real time.

Today, PowWater has raised a total of $5.6 million.

By connecting Africa to the same pipes as the rest of the world, Carta helps money flow more quickly during fundraising or exits.

The result? African companies and investors can unlock more liquidity - with faster investments and faster exits.

And LPs will have clearer access to data and deploy more in less time.

It’s the same capital - but moving at the speed of trust. What do you think about Carta’s entry into Africa?

PS: Carta is officially landing in Africa next week and hosting their Brew & Build Event in Cape Town, hosted by Tech Safari. It’s on the morning of Friday, December 5th.

How We Can Help

Before you go, let’s see how we can help you grow.

Get your story told on Tech Safari - Share your latest product launch, a deep dive into your company story, or your thoughts on African tech with 60,000+ subscribers.

Create a bespoke event experience - From private roundtables to industry summits, we’ll design and execute events that bring the right people together around your goals.

Hire the top African tech Talent - We’ll help you hire the best operators on the continent. Find Out How.

Something Custom - Get tailored support from our Advisory team to expand across Africa.

That’s it for this week. See you on Sunday for a breakdown on This Week in African Tech.

Cheers,

The Tech Safari Team

PS. refer five readers and you’ll get access to our private community. 👇🏾

What'd you think of today's edition? |

Wow, still here?

You must really like the newsletter. Come hang out. 👇🏾